Published on: May 14, 2025

Home cash buyers are on the rise, fueling a lasting trend of all-cash transactions that have surged in the housing market over the past two years. More homeowners are opting for quick, cash-based sales rather than traditional sales involving mortgages. Learn how Home Cash Buyers are transforming the real estate game, especially in New Haven CT.

National Association of REALTORS® estimated that cash buyers made up 32 percent of the market. Data from Goldman Sachs noted a significant increase in all-cash home purchases in recent years, with the number of all-cash sales more than doubling since 2016. This suggests a growing preference for cash offers in the market. Whatever the number may be, it is clear that cash sales have been a much bigger factor in the current housing recovery than in previous housing surges. Is this trend a good thing or a bad thing for housing long term?

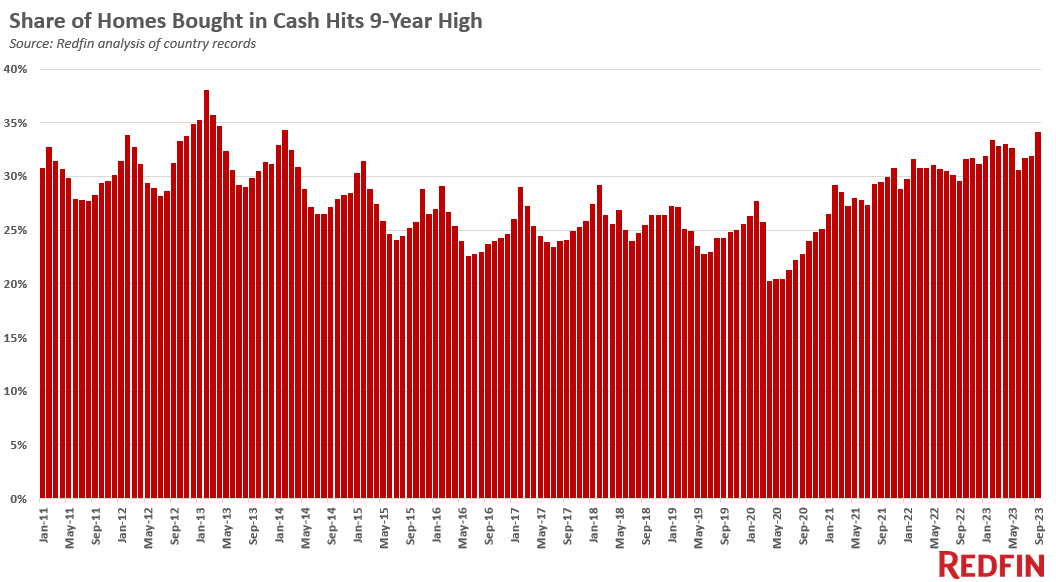

Driven in part by elevated mortgage rates, the share of homebuyers paying in cash has increased. According to Redfin, 34.1% of U.S. home purchases in September 2023 were all-cash deals, up from 29.5% in September 2022, when borrowing costs were lower.

By 2025, the trend appears even more pronounced—especially in the luxury market. In the three months ending February 29, 2024, 46.8% of luxury homes were purchased entirely with cash, the highest percentage in over a decade, and up from 44.1% during the same period a year prior.

Redfin analyzed county records across 40 of the most populous U.S. metropolitan areas, going back through 2011. An all-cash purchase is one in which there is no mortgage loan information on the deed

There’s one clear reason—and several less obvious ones—behind the growing number of all-cash home purchases. Beyond the financial factors, there are also psychological motivations that influence this trend.

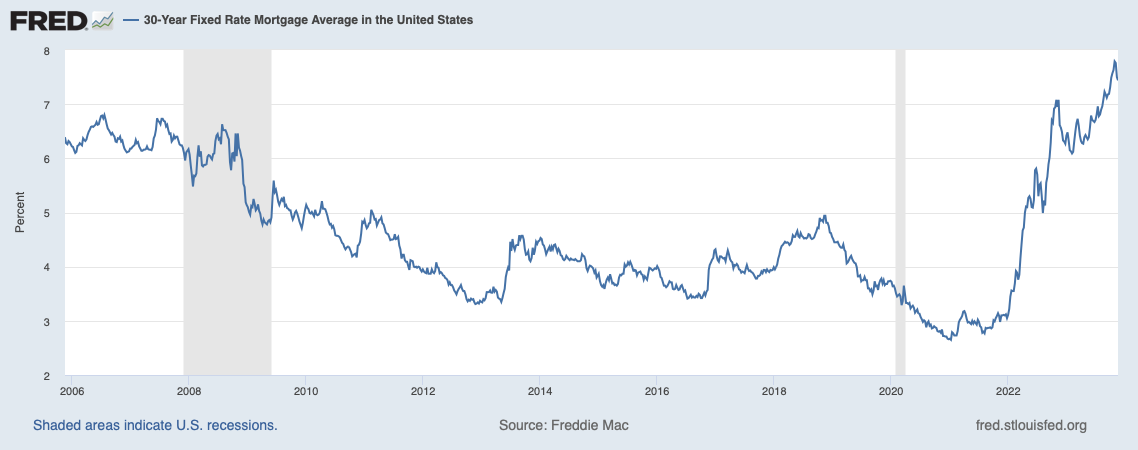

The most obvious reason for the increase in all-cash home purchases is the surge in mortgage rates. The average 30-year fixed rate jumped from around 2.75% in 2020 to roughly 7.15% in 2024. As borrowing becomes more expensive, more buyers are choosing to avoid loans altogether and pay in cash.

However, paying all cash in a high-interest environment also comes with a trade-off: you forgo the opportunity to earn attractive, low-risk returns elsewhere. Right now, money market funds and Treasury bonds are yielding 4.5% or more. Still, since mortgage rates are even higher, paying in cash can offer a net financial benefit despite the opportunity cost.

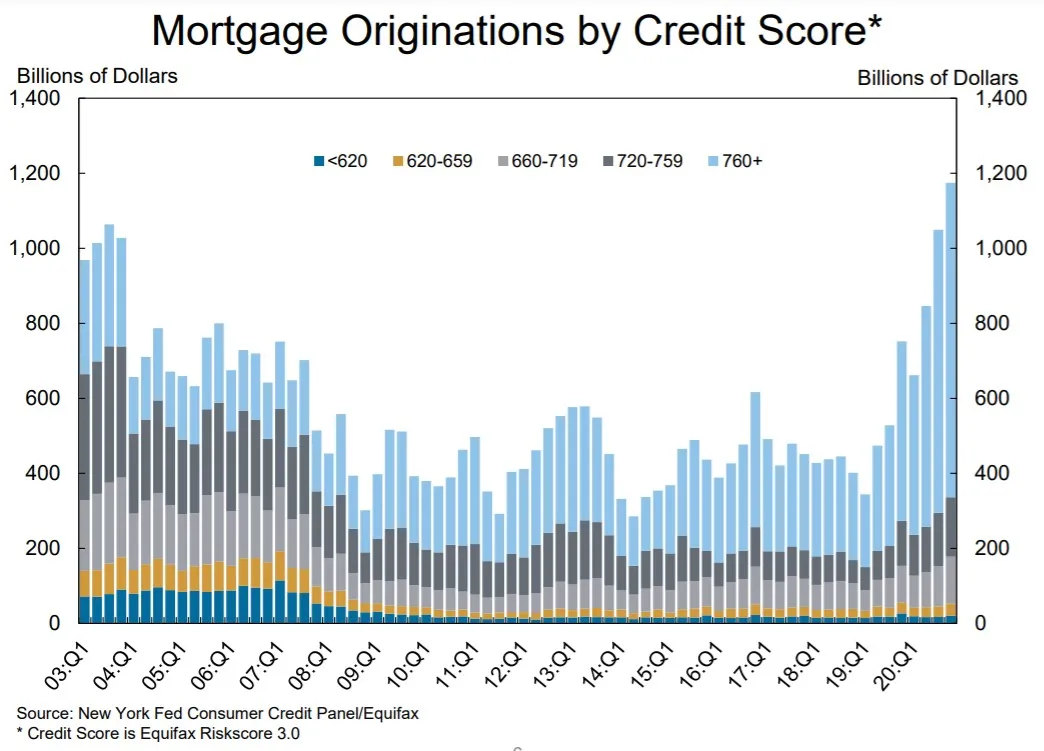

A less obvious reason for the rise in all-cash home purchases is that it’s simply harder to get a mortgage today. Since the 2008 global financial crisis, lending standards have tightened significantly. In response to the crisis, the government required banks to raise their Tier 1 capital ratios to reduce the risk of insolvency. As a result, banks have become much more selective about who qualifies for a home loan.

For instance, the average credit score for approved mortgage applicants is now over 720—a score considered excellent. Before the financial crisis, the average approved score was closer to 680, which is still good but notably lower.

Mortgage origination data highlights this shift. Starting around 2009–2010, there’s been a noticeable increase in the share of mortgages going to borrowers with credit scores of 760 and above. Stricter lending standards mean fewer people can qualify for loans, pushing more buyers—especially those with access to liquid assets—to pay in cash instead.

This trend could also suggest that families are pooling resources to help relatives buy homes, or that “stealth wealth” (hidden or underestimated personal wealth) is more common than expected. Still, on average, buyers with lower credit scores tend to be less wealthy than those with higher scores, making it harder for them to compete in today’s housing market.

The increasing prevalence of all-cash home purchases in the U.S., driven primarily by high mortgage rates and stricter lending standards, is significantly impacting local markets like New Haven, Connecticut. Here’s how these two main factors are influencing the housing landscape in New Haven:

With mortgage rates reaching their highest levels in over two decades—averaging around 7.57% for a 30-year fixed loan in late 2024—financing a home has become considerably more expensive. This surge in borrowing costs makes cash offers more attractive to sellers, as they eliminate the uncertainties associated with mortgage approvals.

In New Haven, this dynamic is particularly evident. The median home price increased by 12.9% in 2024, reaching approximately $350,000. Such price hikes, coupled with high interest rates, have made it challenging for buyers relying on financing to compete, thereby giving cash buyers a competitive edge in the market.

Post-2008 financial crisis regulations have led to more stringent lending standards, making it harder for many potential buyers to qualify for mortgages. In Connecticut, the average credit score for approved mortgage applicants has risen, reflecting these tighter requirements. This situation disproportionately affects first-time and lower-income buyers, who may struggle to meet the elevated credit criteria.

In New Haven, where housing demand remains robust, these stricter lending standards mean that a significant segment of potential buyers is effectively sidelined, unable to secure financing. Consequently, sellers are more inclined to accept cash offers, which are perceived as more reliable and less likely to fall through due to financing issues.

The dominance of cash buyers in New Haven’s housing market has several notable consequences:

To address these challenges, initiatives like the state’s allocation of nearly $90 million to support housing developments in New Haven aim to increase the availability of affordable units. These efforts are crucial in ensuring that the housing market remains accessible to a diverse range of buyers, not just those capable of making cash purchases

Zee Holdings simplifies the home-selling journey by eliminating the complexities of traditional real estate transactions. Their streamlined approach ensures a quick and hassle-free sale, allowing you to move forward without unnecessary delays.

Unlike many other buyers, Zee Holdings charges absolutely no hidden fees or service charges. There are no commissions or closing costs, ensuring that the offer you receive is the amount you take home. This transparency helps you avoid unexpected expenses and provides peace of mind throughout the process.

Zee Holdings makes fair, no-obligation cash offers based on a comprehensive evaluation of your property’s condition and market value. Their team considers comparable sales, property conditions, and other financial factors to ensure you receive a competitive offer.

Understanding that each homeowner’s situation is unique, Zee Holdings offers flexible closing dates to accommodate your timeline. Whether you need to sell quickly or require more time, they work with you to find a solution that fits your needs.

Zee Holdings buys a wide range of properties, including single-family homes, multi-family units, condominiums, and vacant lots. Whether your property is in pristine condition or requires repairs, they are prepared to make an offer. This versatility makes them a reliable choice for homeowners in diverse circumstances.

In summary, if you’re looking to sell your home for cash in New Haven, CT, Zee Holdings offers a transparent, efficient, and flexible solution tailored to your needs. Their commitment to fair offers and customer satisfaction makes them a standout choice in the local market.

Just fill in this simple form and We’ll get back to you as soon as possible!